property tax las vegas nv

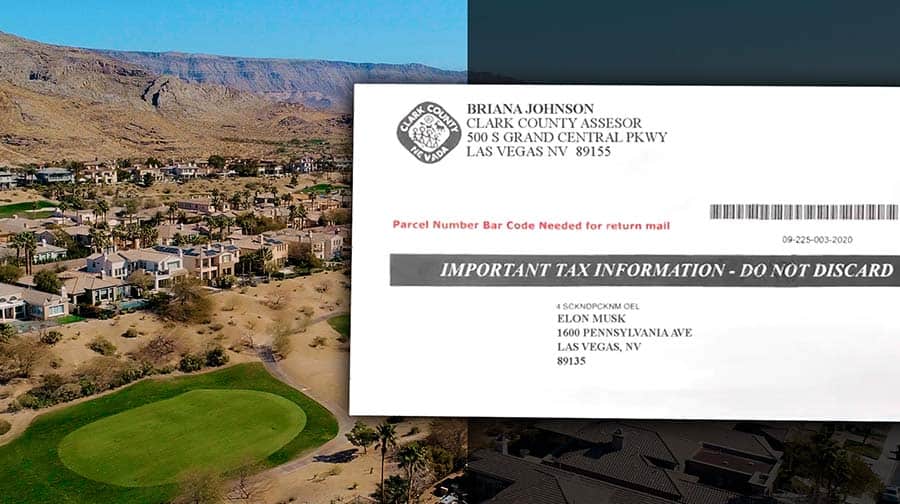

Every municipality then receives the assessed amount it levied. Under state law as a property owner you can apply for a three percent tax cap on your primary residence.

How Much Can Green Amenities Lower Property Tax Bills In Las Vegas Mansion Global

Office of the County Treasurer.

. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. Establishing tax levies evaluating property worth and then collecting the tax. Road Document Listing Inquiry.

THIS CUSTOM HOME LOCATED IN GUARD GATED TEN OAKS OFFERS 8. To ensure timely and. In Nevada the market value of your property determines property tax amounts.

Payment Options for Real Property Taxes only Mail. You may find this information in Property Tax Rates for Nevada. If you do not receive your tax bill by August 1st each year please use the automated telephone system to request a copy.

Tax Records include property tax assessments property appraisals and income tax records. Once every 5 years your home is required to be re. Such As Deeds Liens Property Tax More.

We provide the most extensive nationwide property tax. Las Vegas NV 89155-1220. LAS VEGAS KTNV You could be paying more on your property tax than you realize.

Las Vegas NV 89106. Overall there are three stages to real property taxation. Checks for real property tax payments should be made payable to Clark County Treasurer.

The exact property tax levied depends on the county in Nevada the property is located in. Get In-Depth Las Vegas Property Tax Reports In Seconds. We are open 730 am.

Search Homes Our Team Our Agents Las Vegas Communities Housing Information Blog Contact Search Homes Our Team Our Agents Las Vegas Communities. Start Your Homeowner Search Today. What is the Property Tax Rate for Las Vegas Nevada.

Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. Las Vegas NV 89106. Las Vegas NV currently has 3992 tax liens available as of October 13.

500 S Grand Central Pkwy 1st Floor. You may pay in person at 500 S Grand Central Pkwy Las Vegas NV 89106 1st floor behind the security desk. In addition Nevadas tax abatement law protects homeowners.

Search Valuable Data On A Property. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in. Washoe County collects the highest property tax in Nevada levying an average of 188900 064 of median home value yearly in property taxes while Esmeralda County has the lowest property.

As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us to ensure their tax burdens are reasonable. Las Vegas Nevada 89155-1220. The states average effective property tax rate is just 053.

Taxing authorities include Las Vegas county governments and many special districts eg. Some of these include veterans disabled veterans surviving spouses blind persons and property owned by religious educational or non-profit organizations. If you disagree with your homes assessed value we would be happy to pull comps for you thats real estate lingo for finding.

Ad Get In-Depth Property Tax Data In Minutes. Search for all public records here including property tax court other vital records. Compared to the 107 national average that rate is quite low.

At the Rob Jensen Company we represent buyers and sellers in Clark County every dayparticularly in Summerlin Las Vegas and Henderson. Tax rates apply to that amount. Tax bills requested through the automated system are sent to the mailing.

Ad Our Property Tax Records Finder Locates Local Records Fast. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. 8 beds 9 baths 12100 sq.

The assessed value is equal to 35 of the taxable value. Las Vegas NV 89155-1220. These buyers bid for an.

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing. The Nevada Legislature provides for property tax exemptions to individuals meeting certain requirements.

Ad Find out directory of all your local government offices online for free. House located at 7440 Oak Grove Ave Las Vegas NV 89117 sold for 2750000 on Dec 31 2015. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more.

Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Las Vegas NV at tax lien auctions or online distressed asset sales. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

Tax Settlements Resolved In Nevada 20 20 Tax Resolution

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

0 11 Acres Of Residential Land For Sale In North Las Vegas Nevada Landsearch

1300 C St Las Vegas Nv 89106 Mls 2141710 Redfin

Property Tax Fight Stalls In Legislature Disappointing Local Governments The Nevada Independent

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Charles Drury On Twitter Cost President Executive Director Douglas Lindholm And Iptiglobal President Paul Sanderson Welcomed Attendees To The Cost Iptiglobal Property Tax Workshop Being Held In Las Vegas This Week Cost2019

Nellis Las Vegas Nv 89104 Realtor Com

Property Tax In Las Vegas Nevada

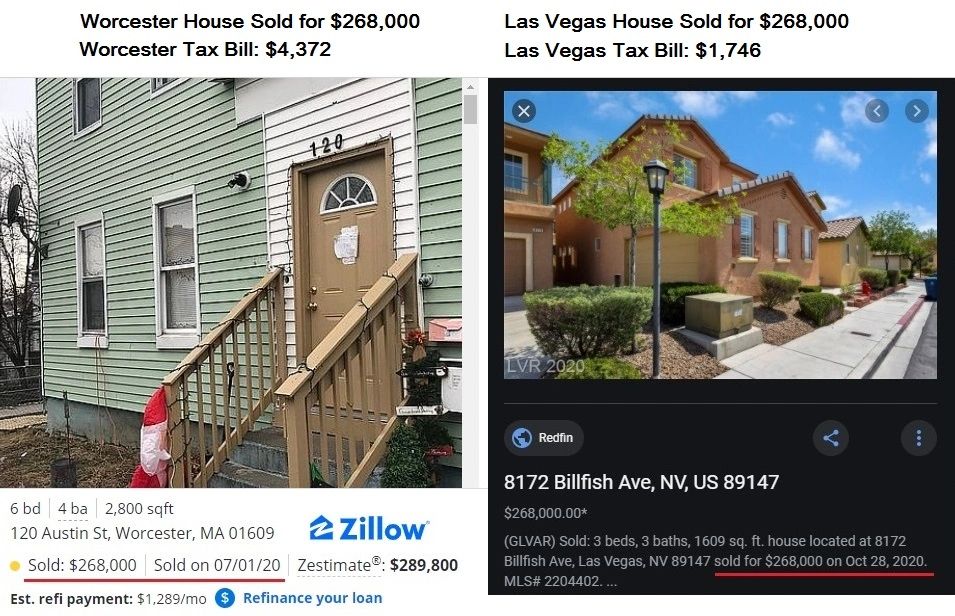

Worcester Property Tax Burden 52 3 Higher Than National Average

Clark County Assessor Addresses Panic With Property Tax Cap

Las Vegas Property Tax Frequently Asked Questions Rob Jensen Company

Taxpayer Information Henderson Nv

Las Vegas Property Tax How Does It Compare To Other Major Cities

Taxpayer Information Henderson Nv

Property Manager Salary In Las Vegas Nv Comparably

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Sisolak Property Tax Cap Forces County To Seek Sales Tax For More Cops Nevada Public Radio